What is Personetics?

- Founders: David Sosna and David Govrin

- Launch: Founded in 2011

- Headquarters: New York, with offices in major global financial hubs

-

Use Cases:

-

Personalized financial insights and recommendations

-

Automated savings and budgeting journeys

-

Real-time transaction data enrichment

-

Cash-flow forecasting for retail and business customers

-

Enhanced customer engagement and loyalty programs

-

-

Technology:

-

AI and machine learning for predictive analytics

-

Cloud-based SaaS model for scalability

-

Data enrichment engine for transaction categorization

-

Cognitive banking architecture for proactive engagement

-

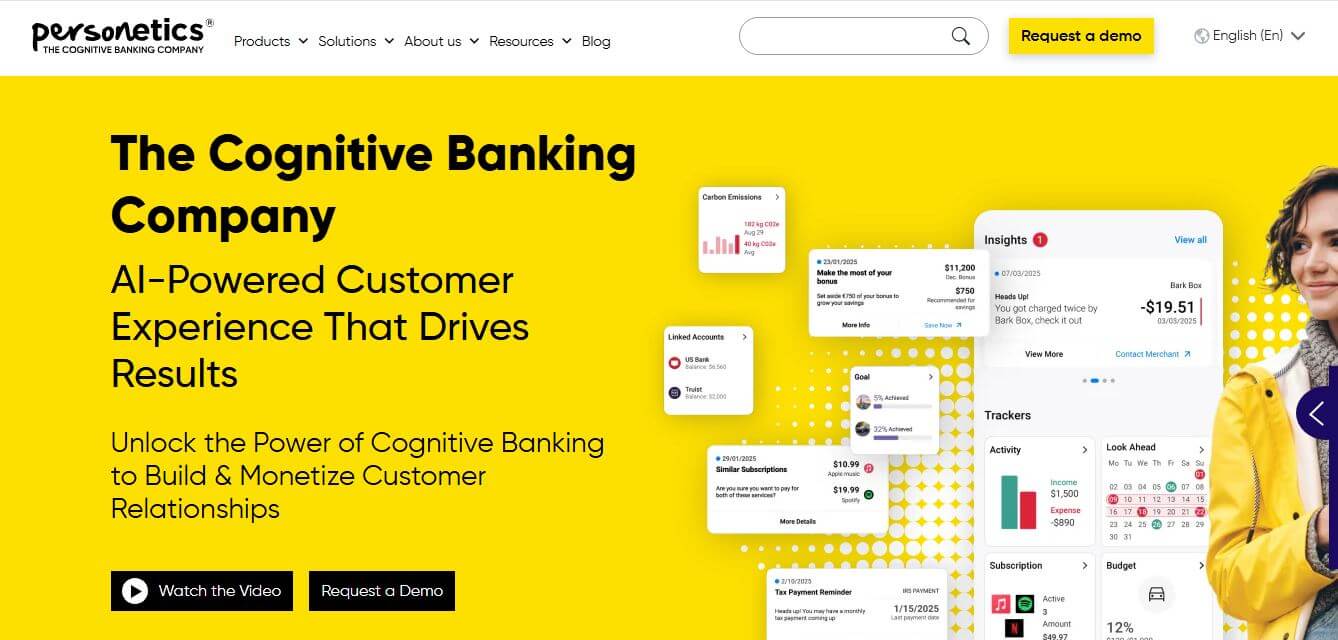

Personetics is an AI-powered finance platform that helps financial organizations offer proactive, connected, and personalized financial experiences. To develop actionable suggestions and automated actions from raw transaction data, Personetics uses advanced data analytics and behavioral science. For banks and credit unions, Personetics's purpose-built platform of real-time engagements, predictive financial guidance, and self-driving money management enables financial institutions to enhance their cognitive banking capabilities by anticipating client needs, providing better financial well-being, and fostering more profound relationships. Personetics is used by more than nine in ten banks across North America to fundamentally change their clients' experience into a hyper-personalized and contextual one while building loyalty, growth, and ultimately better decisions around money.

Key features

Personetics key features are

- Real-time actionable information for banking customers, setting the stage for a collaborative experience

- Automated journeys for savings, budgeting, and cash flow

- Predictive analytics anticipating customer financial needs

- Tools for categorization and enrichment of transaction data

- A customizable builder for financial institution engagement

- Easy integration with existing digital banking platforms

- Support for retail and SME banking

- A tried-and-true way to increase engagement and customer satisfaction digitally

Pricing

- Custom enterprise pricing

- Subscription-based model

- Institution-specific quotes

Disclaimer: For the latest and most accurate pricing information, please visit the official Personetics website.

Who is using it?

A wide range of users and organizations are using Personetics

- Global retail banks

- Credit unions worldwide

- Digital banking platforms

- Financial institutions at scale

Alternatives

Some Personetics alternatives are

- Meniga

- MX

- FinGoal

- Bud Financial

- Strands

Conclusion

Personetics has established itself as a top player in changing banking with AI. The platform helps banks move from just handling transactions to actively engaging with customers. By using predictive analytics, automation, and personalization, Personetics enables banks to connect with customers in a meaningful way and improve their financial health and loyalty. With proof of success in markets around the world, Personetics is a well-respected partner for banks looking to boost their digital skills, enhance customer engagement, and get ready for the future of banking.

Verified

Verified